Long queues at revenue district offices (RDOs) are over as the Bureau of Internal Revenue (BIR) has launched digital TIN (Taxpayer Identification Number) ID!

The digital TIN ID scheme is part of a memorandum circular released on November 29 and under BIR’s Online Registration and Update System (ORUS), where BIR stated that the public can now avail of the digital TIN ID without charge.

The digital TIN ID will serve as a government-issued identification document accepted by various government agencies, local government units, banks, employers, and other institutions.

Although both the physical TIN cards and digital TIN IDs remain valid, the latter doesn’t need a signature as its authenticity can be verified by scanning the QR code on it via the agency’s online registration and update system (ORUS). Further, one doesn’t need to acquire a physical card if he/she has a digital TIN ID.

According to BIR, the new digital TIN ID tends to address the practice of fixers and scammers who sell TIN online in exchange for giving taxpayers hassle-free and alternative ways of getting a TIN, instead of lining up at RODs. BIR advised the Filipinos that digital TIN ID is free of charge and not for sale so they can avoid fake TIN.

How to apply for a digital TIN ID?

Before anything else, taxpayers who want to get a digital TIN ID must first update their email address at their respective RDOs where they are registered. In order to do that they must accomplish and submit Form S1905 – Registration Update Sheet via email to the concerned RDO or through BIR’s eServices – Taxpayer Registration Related Application Portal.

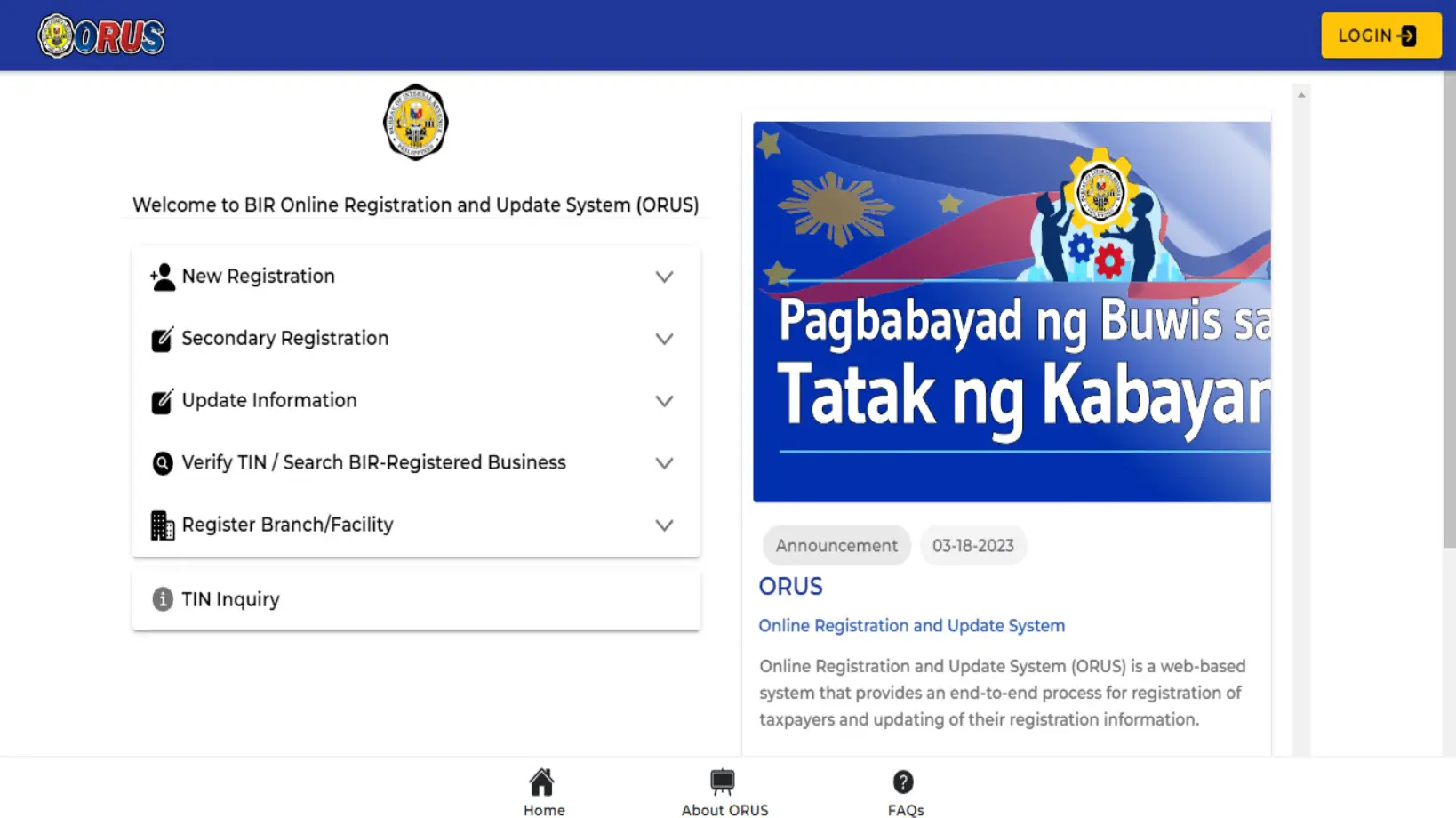

Step 1: To apply for a digital TIN ID, you must enroll an account at http://orus.bir.gov.ph/.

Step 2: You will be be asked whether you are registering as a taxpayer or tax agent, and if you have an existing TIN or not.

Step 3: If you have an existing TIN, you will be asked to provide personal information such as your name, date of birth, civil status, gender, and email. You must also create a password for your account.

Step 4: However, you can also be asked first of whether you are getting TIN as a foreign national, a Filipino citizen, or an overseas Filipino worker, and registering business as a professional and/or single proprietorship before you provide your personal information and creating a password.

Step 5: Now that you created an individual’s ORUS account, you must upload your photo.

Step 6: According to BIR, your photo must be 1×1 with a white background and no border. It must resemble you and it should be captured in the last six months.

Step 7: BIR noted that you must face the camera directly, having both of your ears visible, with a neutral expression or smile, without showing your teeth, and your eyes must be visibly open. You must not be looking down or sideways and your face must not be covered.

Step 8: Head coverings or hats because of religious beliefs are acceptable, provided that they don’t cover the individual’s face.

Step 9: Sunglasses and other accessories that will hide your face are not acceptable. But if for medical reasons, like an eye patch it is allowed. Meanwhile, facemasks or veils aren’t allowed.

Step 10: BIR warned that those who upload unrelated photos like animals, artists, cartoons, or other people shall be subject to penalty.

It is important to note that photos that don’t adhere to the BIR’s specifications would make one’s digital TIN ID invalid. Additinally, those who want to update their information such as name, address, or change of RDO must regenerate their digital TIN ID 30 days after the first one.

BIR also warned those who give false information as they can be subjected to a fine of at least P10,000 and imprisonment ranging from 1 to 10 years.