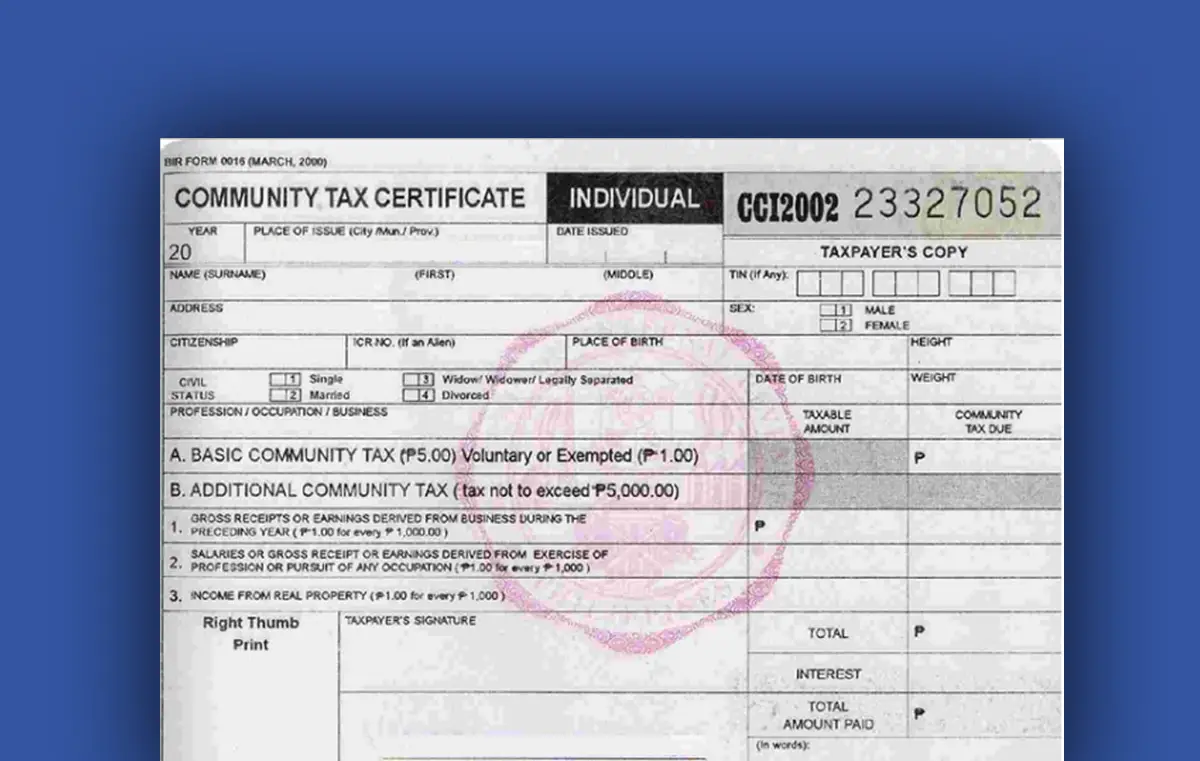

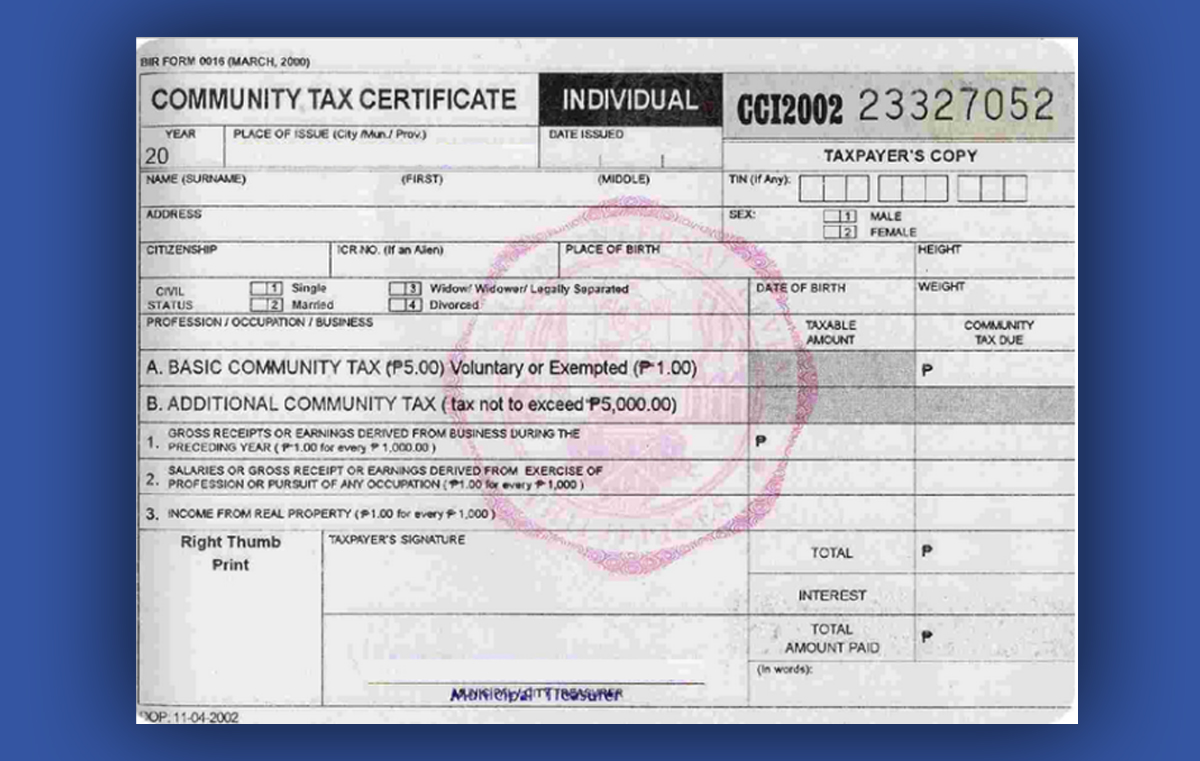

A Community Tax Certificate (CTC), commonly known as a cedula, is a vital document in the Philippines, serving both as a form of identification and proof of tax payment. Issued by local government units (LGUs), the cedula is essential for various official transactions and has a rich historical significance.

What is a Cedula?

A cedula is an identity document issued to Filipino residents upon payment of the community tax. It contains personal information such as full name, address, date of birth, citizenship, civil status, occupation, and tax identification number. Additionally, it includes physical descriptors like height, weight, and the individual’s right thumbprint. The issuing officer’s signature and the date and place of issuance are also indicated.

Historical Context

The concept of the cedula dates back to the Spanish colonial period. Introduced in the 19th century, it was a residence tax certificate required from all natives aged 18 to 60. The cedula played a pivotal role during the Philippine Revolution when members of the Katipunan tore their certificates in defiance of Spanish rule, symbolizing the fight for freedom.

Who Needs to Get a Cedula?

Under the Local Government Code of 1991, the following individuals are required to obtain a cedula:

1. Filipino Residents

All Filipinos aged 18 years and above who have lived in a city or municipality for at least one year.

2. Business Owners and Self-Employed Individuals

Anyone engaged in business, whether as a sole proprietor, freelancer, or independent contractor.

3. Real Property Owners

Individuals who own land, houses, or buildings with an assessed value of at least ₱1,000.

4. Corporations and Organizations

- Any company, association, or cooperative operating in the Philippines must secure a corporate cedula.

- Government agencies, non-profit organizations, and registered businesses are also required to secure a cedula annually.

Why is a Cedula Important?

A cedula is needed for various legal and official transactions, such as:

1. Proof of Identity

The cedula is often used as a secondary ID for transactions that require government-issued identification.

2. Business and Employment Requirements

Required for business permits, barangay clearance, and employment applications.

3. Legal and Notarial Documents

Acknowledging documents before a notary public, such as contracts, affidavits, and special powers of attorney.

4. Government Transactions

Needed when applying for:

- Marriage license

- Building permits

- Filing income tax returns (ITR)

- Opening a bank account

5. Court and Police-Related Transactions

Some legal proceedings may require a cedula, such as when filing cases or securing police clearance.

How Much Does a Cedula Cost?

The cost of obtaining a cedula varies based on income and occupation.

For Individuals:

Basic community tax: ₱5

Additional tax: ₱1 for every ₱1,000 of annual income

Maximum tax: ₱5,000

For Businesses & Corporations:

Minimum tax: ₱500

Additional tax based on gross receipts, total assets, and land ownership

How to Get a Cedula in the Philippines

Step 1: Visit Your Local Government Office

Go to your nearest city hall, or municipal hall. While some barangays issue cedulas, others may direct you to the city or municipal hall.

Step 2: Provide Personal Information

Prepare the following details:

- Full name, address, and date of birth

- TIN (if applicable)

- Annual income (if applicable)

Step 3: Present a Valid ID

Bring a government-issued ID such as a passport, driver’s license, or national ID for verification.

Step 4: Pay the Required Fee

The amount will depend on your income and business earnings. Payments are made at the treasury office or designated payment counters.

Step 5: Receive Your Cedula

After processing, you will receive your Community Tax Certificate with an official receipt.

Validity and Usage

The cedula is valid for one year from the date of issuance. It’s commonly required in various situations, such as:

- Registering or renewing a business.

- Applying for certain government-issued IDs.

- Notarizing documents.

- Applying for a marriage license.

- Filing income tax returns.

While its necessity has diminished in some areas, the cedula remains a recognized document for specific transactions.

Frequently Asked Questions (FAQs)

1. Can I get a cedula online?

Some LGUs have started offering online application services. Check with your local city or municipal hall if online processing is available.

2. Can foreigners get a cedula?

Foreigners who own property or operate businesses in the Philippines may need a cedula.

3. Is a cedula still required today?

While the cedula is no longer as widely used, some government agencies and private institutions still require it for transactions.

Conclusion

The cedula, or Community Tax Certificate, continues to be an integral part of the Philippine administrative system. Understanding its purpose, the process of obtaining it, and its applications ensures that individuals can navigate various official transactions smoothly.

Check Also: Barangay Clearance | Requirements | Guide How to Apply