The state-run social insurance institution for government workers- Government Service Insurance System (GSIS) has introduced a new loan program for its members namely the GSIS Multi-Purpose Loan (MPL) Lite.

What is GSIS MPL Lite?

The GSIS MPL Lite is a short-term loan program that intends to supplement the immediate needs of active members who have sufficient Net Take Home Pay (NTHP) to qualify for additional GSIS loan/s or renewal of existing loans.

The new loan scheme was established in order to cater its members with their immediate and unexpected expenses and temporary budget gaps offering an accessible financing that ranges from ₱5,000 to ₱50,000 (multiple of five).

Read: (GSIS) launches the 2.0 version of GSIS Touch

Members may apply for a one-time loan redemption insurance fully deducted upfront waving fees for early repayment and free service fee for those who have active MPL Flex.

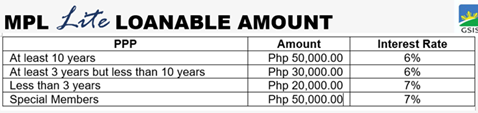

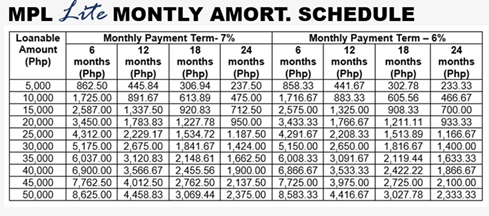

The amount loaned may be repaid by members using a flexible repayment terms of six, 12, 18 or 24 months accumulating a competitive interest rates of 6% or 7%, based on years of service.

All loans that will be approved shall have the funds credited to members within three days.

Read: GSIS Educational Subsidy to Selected 10,000 Students – Qualifications and Requirements

Who are Qualified for GSIS MPL Lite?

Those active members under permanent and non-permanent status, together with Special Members tagged as such in their respective Member’s Service Profiles (MSPs) whose agency have a MOA with GSIS are eligible to apply for the program, provided that they are:

- not on leave of absence without pay at the time of application;

- have at least one (1) month premium contributions for both personal share and government share at the time of application;

- have no pending administrative case and/or criminal case; provided however, that if the pending administrative case or charge is for

a light offense, the borrower shall remain eligible. - have no GFAL account in default except housing loan;

- the agency status is not “suspended”; and

- the resulting net take-home pay after loan availment is not lower than the amount required under the general appropriations act, after

all required monthly obligations have been deducted.

Read: List of GSIS Benefits available for their Members

Loanable Amount/ Interest Rate

Payment Term

Member-borrowers may opt to pay the loan within 6, 12, 18, or 24 months.

Monthly Amortization

GSIS highlighted that the emerge of the new MPL Lite shall only not serve as another loan program for financial stability, it also helps members avoid predatory lending practices and regain control over their finances and secure their financial future.

How to Apply for GSIS MPL Lite?

The full application options and requirements shall be accessed at GSIS Touch Mobiles App. The QR Code GSIS Touch are accessible through the photo below taken by GSIS.

Read: How to View or Check GSIS Records Online

How to loan?