The Pag-IBIG MP2 (Modified Pag-IBIG II) savings program is an attractive investment option for Filipinos looking to earn high dividends with government backing. Whether you’re a seasoned investor or just starting your savings journey, the Pag-IBIG MP2 program offers a safe and reliable way to grow your money. In this guide, we’ll cover everything you need to know about Pag-IBIG MP2, including its benefits, eligibility, requirements, and how to maximize your earnings.

What is Pag-IBIG MP2?

The Modified Pag-IBIG II (MP2) Savings Program is a voluntary savings scheme offered by the Pag-IBIG Fund (Home Development Mutual Fund – HDMF). It is designed for both active Pag-IBIG members and retired Filipinos who wish to invest their extra cash in a high-yield savings program. The MP2 program offers higher dividend rates compared to the regular Pag-IBIG savings program, making it an excellent choice for those looking to grow their money securely.

Benefits of Pag-IBIG MP2

1. High Dividend Rates

Pag-IBIG MP2 typically offers higher annual dividends than traditional bank savings accounts. In recent years, dividend rates ranged between 6% to 8%, making it a competitive investment vehicle.

2. Government-Backed Savings

Unlike private investment options, Pag-IBIG MP2 is government-guaranteed, meaning there is very little risk of losing your capital.

3. Tax-Free Earnings

The dividends earned from MP2 are tax-free, allowing you to enjoy the full benefits of your investment.

4. Flexible Contributions

- Minimum contribution: PHP 500 per month

- No maximum limit: You can deposit as much as you want, as long as it comes from legal sources of income.

5. Short-Term Investment Option

Unlike other long-term investment plans, the Pag-IBIG MP2 has a 5-year maturity period, making it ideal for medium-term financial goals.

6. Multiple MP2 Accounts Allowed

You can open multiple MP2 accounts to diversify your investment and maximize your earnings.

7. Dividends Can Be Withdrawn Annually or Upon Maturity

- Option 1: Receive dividends annually (recommended if you need additional yearly income).

- Option 2: Let the dividends compound and withdraw everything after 5 years (recommended for higher returns).

Who Can Open a Pag-IBIG MP2 Account?

To qualify for Pag-IBIG MP2, you must be:

- A Pag-IBIG Fund member (whether employed, self-employed, or voluntary member)

- A former Pag-IBIG member with at least 24 monthly contributions

- A retired Filipino with existing contributions and willing to save voluntarily

How to Open a Pag-IBIG MP2 Account

Step 1: Prepare the Requirements

- Pag-IBIG MID Number

- Valid ID (e.g., Passport, Driver’s License, UMID, etc.)

- Initial deposit (PHP 500 or more)

- Active email address and mobile number

Step 2: Open an MP2 Account Online or In-Person

You can register online via the Pag-IBIG Fund MP2 Enrollment System:

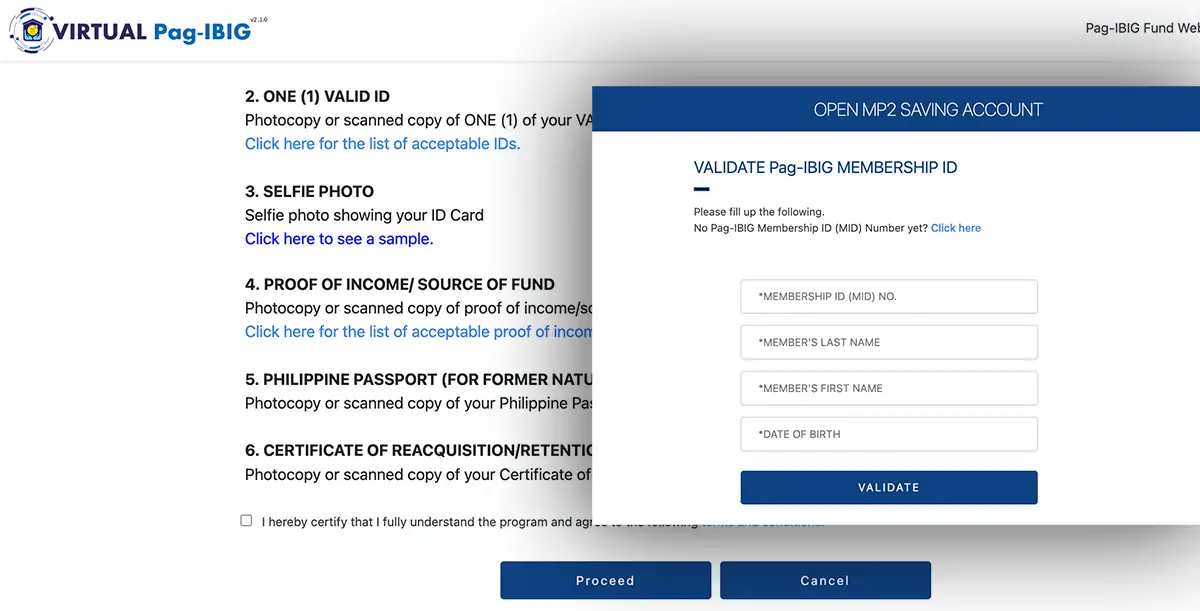

- Got to the Pag-IBIG MP2 application website. Read the requirements, accept the terms and conditions then proceed.

- You need to be a Pag-IBIG Fund member to enroll in Pag-IBIG MP2.

- Validate your Pag-IBIG Membership ID

- Fill out the application form

Alternatively, you can visit a Pag-IBIG branch and fill out the MP2 form manually.

Step 3: Start Depositing to Your MP2 Account

You can deposit through:

- Pag-IBIG Branches (Over-the-counter payment)

- Salary Deduction (for employees)

- Online Banking & E-Wallets (GCash, Maya, Coins.ph, etc.)

- Bayad Centers & Partner Banks

How to Maximize Your Pag-IBIG MP2 Savings

- Save Consistently – Set a fixed monthly contribution (e.g., PHP 1,000 to PHP 5,000) to benefit from compounded growth.

- Choose Dividend Payout Wisely – Opting for the 5-year maturity payout yields higher returns due to compounded interest.

- Invest Extra Money – Instead of leaving your money idle, allocate bonuses and extra cash to MP2.

- Open Multiple MP2 Accounts – Diversify your savings by opening multiple MP2 accounts to separate short-term and long-term goals.

- Monitor Dividend Rates – Stay updated on Pag-IBIG MP2’s latest dividend rates and adjust contributions accordingly.

FAQs About Pag-IBIG MP2

1. Is Pag-IBIG MP2 better than a bank savings account?

Yes! MP2 offers higher interest rates (6-8%) compared to bank savings accounts, which only offer 0.5-1% per year.

2. Can I withdraw my savings before 5 years?

Yes, but early withdrawal is subject to Pag-IBIG’s terms and conditions. Reasons like disability, death, or migration allow early withdrawal without penalties.

3. What happens after 5 years?

You can either withdraw your MP2 savings or reinvest it in a new MP2 account to continue earning dividends.

4. How secure is Pag-IBIG MP2?

MP2 is government-backed and low-risk, making it one of the safest investment options in the Philippines.

5. Can OFWs invest in MP2?

Yes! Overseas Filipino Workers (OFWs) can enroll and remit contributions via online banking and international remittance partners.

Final Thoughts: Is Pag-IBIG MP2 Worth It?

Absolutely! The Pag-IBIG MP2 savings program is a smart, safe, and high-yield investment for Filipinos. Whether you’re saving for retirement, education, or a future home, MP2 allows you to grow your money securely with minimal risk.

With high dividends, government backing, tax-free earnings, and flexible contribution options, Pag-IBIG MP2 is one of the best financial tools for Filipinos looking to secure their future.

Check Also: Virtual Pag-IBIG: Registration, Benefits, Complete Guide

i want to join MP2 Po pero many years ago na po ako nkpag stop may mayad sa PAG IBIG.

Pwede po mag join basta alam ninyo yung pag-IBIG MID or number ninyo.

How to apply im ofw?

Paki sundan lang po instruction dito https://announcement.ph/pag-ibig-mp2/#How_to_Open_a_Pag-IBIG_MP2_Account