The Social Security System (SSS) Employer Login is an essential online tool for businesses in the Philippines. It allows employers to manage contributions, employee records, and other SSS-related transactions efficiently. Whether you’re a new employer or an experienced one, understanding how to navigate the SSS employer portal is crucial for compliance and smooth business operations.

In this guide, we’ll cover everything you need to know about the SSS Employer Login, including registration, step-by-step login procedures, common issues, and troubleshooting tips.

What is the SSS Employer Login?

The SSS Employer Login is an online service provided by the Social Security System of the Philippines. It allows registered employers to access the My.SSS Portal, where they can perform various transactions, such as:

- Submitting monthly contributions

- Checking employee records

- Generating payment reference numbers (PRNs)

- Updating company information

- Managing employee benefits

How to Register for an SSS Employer Account

Before you can log in, you must first register your business with the SSS. Here’s how:

Step 1: Prepare the Required Documents

Ensure you have the following documents ready:

- Employer Registration Form (SS Form R-1)

- Employment Report Form (SS Form R-1A)

- Business permit or SEC/DTI registration certificate

- Proof of business operation (e.g., Mayor’s permit, tax return, etc.)

Step 2: Submit Your Application

Visit the nearest SSS branch and submit the required documents. Once your application is approved, you will receive your Employer Number (ER Number).

Step 3: Enroll in the My.SSS Employer Portal

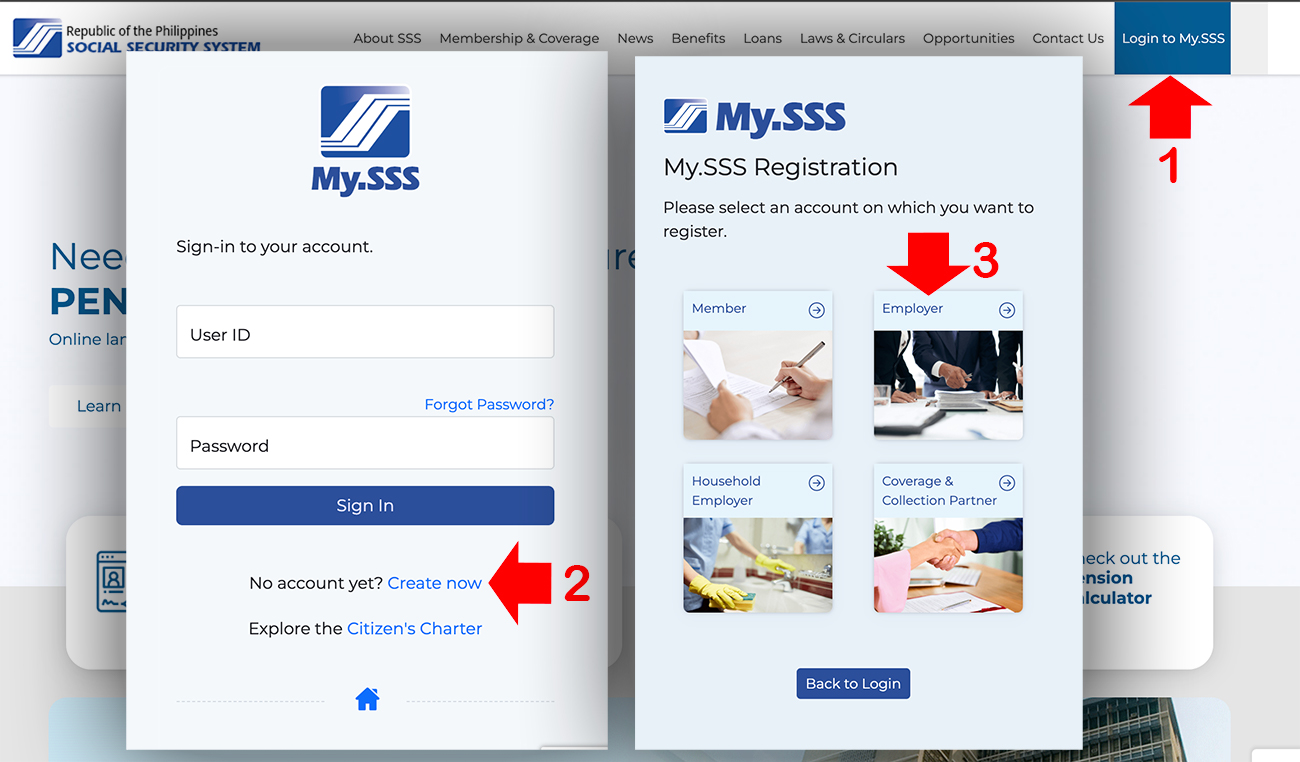

Once you have your ER Number, follow these steps to enroll in the My.SSS Portal:

- Go to the official SSS website (https://www.sss.gov.ph).

- Click on Login to My.SSS on the right side of the menu bar.

- Just below the Sign In button, you will see No account yet? Create now.

- Select Employer and Provide the necessary business information.

- Verify your email and activate your account.

How to Access the SSS Employer Login

Once registered, follow these steps to access your employer account:

Step 1: Visit the Official SSS Website

- Open your browser and go to https://www.sss.gov.ph.

- Click on Login to My.SSS on the right side of the menu bar.

Step 2: Enter Your Credentials

- Input your Employer User ID and Password.

- Click Sign In.

Step 3: Navigate the Employer Dashboard

Once logged in, you can:

- Check contribution status

- Download and print PRNs

- Process employee loans

- Update employer details

Common Login Issues and How to Fix Them

Many employers encounter login issues. Here are some common problems and their solutions:

1. Forgot Password

- Click on Forgot Password?

- Enter your registered email.

- Follow the reset instructions sent to your email.

2. Account Locked

If you input incorrect login details multiple times, your account may be locked. To unlock it:

- Contact the SSS hotline at (02) 8920-6446 or email [email protected].

3. Website Errors or Downtime

- Clear your browser cache and cookies.

- Try using a different browser (Chrome, Firefox, Edge).

- Access the site during non-peak hours.

Benefits of Using the SSS Employer Portal

Using the SSS Employer Login provides numerous advantages:

1. Convenience

Employers can manage SSS transactions 24/7 without visiting an SSS branch.

2. Accuracy

Automated computations reduce errors in contributions and payments.

3. Faster Processing

Generate PRNs and update employee records instantly.

4. Secure Transactions

The portal uses encryption and authentication features to protect employer and employee data.

How to Pay SSS Contributions Online

After logging into your account, follow these steps to pay your contributions:

- Go to Payment Reference Number (PRN) – Contributions.

- Generate a PRN for the applicable payment period.

- Choose your preferred payment method:

- SSS-accredited banks (BDO, Landbank, etc.)

- GCash or PayMaya

- Bayad Center or SM Payment Centers

- Make the payment and keep the transaction receipt.

Frequently Asked Questions (FAQs)

1. Can I register my business for an SSS Employer Account online?

No, initial registration must be done at an SSS branch. However, once registered, you can enroll in the My.SSS Employer Portal online.

2. What should I do if I forget my Employer User ID?

You can retrieve it by clicking Forgot User ID? on the login page and following the email verification process.

3. How often should I pay SSS contributions?

Employers must remit SSS contributions on or before the due date based on their business registration type.

4. What is the SSS employer penalty for late payments?

Late contributions incur a 3% penalty per month based on the total amount due.

5. Can I update my company information online?

Yes, you can update basic employer details via the Employer Portal. However, major changes (e.g., company name, ownership) must be processed at an SSS branch.

Conclusion

The SSS Employer Login is an essential tool for Philippine businesses to manage employee benefits, contributions, and other SSS-related tasks efficiently. By following the registration and login process outlined in this guide, you can ensure compliance with SSS regulations while streamlining your business operations.

For any issues, always contact SSS support through their official website or hotline for assistance.

Check Also: SSS Member Login: Everything You Need to Know

Disclaimer: This article is for informational purposes only and does not constitute official advice from the Social Security System (SSS). Employers are encouraged to verify all information with the official SSS website or contact SSS directly for any concerns regarding their accounts and transactions.

Hi my account was locked, kindly check my sss account

Please visit nearest SSS office, don’t give any details about your account to anyone.

Payment reference number

Good Day!! Panu po ba gagawin pag na locked ung SSS portal at password po?

Good day Po can I ask Po kung ano sss number kpo nawala Po kasi Yung I\’d Po at apply na Rin Po Ng id thank you Po.