In the Philippines today, there are several booming businesses which to name a few are online shops and start-up enterprises. Akin to a vehicle’s CR, it is necessary for a business owner to have a business permit issued as a proof or evidence that he can legally operates a specific business.

In accordance to that, in this article, we will give you a clear understanding on the steps, requirements and fees of getting a business permit so you can start setting up your own business without any problems.

Why do you need a Business Permit?

To put it simpler, you need a business permit, which is also known as the mayor’s permit, to certify that your business is legitimate and to prove that you can legally operate in its registered place.

Additionally, it is also necessary to make sure that your business pays taxes, abide with the local regulations such as safety, security, health and sanitation. So, if you don’t want your business to penalize a significant fine, jail time, or temporary halt of your business operations, you must secure your business permit beforehand.

What are the things you need to consider before filing your Business Permit Application?

1. Make your business permit a priority

You should prioritize your business permit application. Technically, it conforms the law, which urge sole proprietors, partnerships, corporations, cooperatives, foundations, and associations in the Philippines to have a business license, credited from their designated LGUs prior to any business launch.

Subsequently, business permit can be use as one of the prerequisites for business loans, government financial assistance programs, BIR registration as well as when you apply as a reseller/distributor of a certain brand or as an online seller on e-commerce marketplaces.

2. Prepare other required documents

Above anything else, to avoid delays and inconvenience, you must ensure a business registration accompanied by other clearances and permits with the appropriate government agency.

Depending on the LGU branches, they may require additional requirements, taxes, and fees but the common requirements for permit applications are mentioned below.

BUSINESS PERMIT REQUIRMENTS

Applicable business registration document:

- Certificate of Business Name Registration (for single proprietors)

- Articles of Partnership (for partnerships)

- Articles of Incorporation (for corporations)

- Certificate of Registration (for cooperatives/foundations/associations)

PURPOSE: Proof of business registration

WHERE TO GET IT:

- For single proprietors – Department of Trade and Industry (DTI)

- Partnerships and corporations – Securities and Exchange Commission (SEC)

- Cooperatives – Cooperative Development Authority (CDA)

- Foundations and associations – The regulating government agency

BUSINESS PERMIT REQUIREMENT:

- Barangay Business Clearance

PURPOSE: Proof of business location

WHERE TO GET IT:

- Barangay hall with jurisdiction over the business location

BUSINESS PERMIT REQUIREMENT:

- Contract of Lease (if renting a commercial space)

- Transfer Certificate of Title / Tax Declaration (if the property is owned)

PURPOSE: Proof of business location and existence

WHERE TO GET IT:

- Owner or building administrator of the leased property (if renting)

BUSINESS PERMIT REQUIREMENT:

- Sketch and photos of the location

PURPOSE: Proof of business location and existence

WHERE TO GET IT:

- Owner or building administrator of the leased property (if renting)

BUSINESS PERMIT REQUIREMENT:

- Locational Clearance / Zoning Clearance

PURPOSE: Proof of compliance with the city’s/municipality’s Comprehensive Land Use Plan and Zoning Ordinance

WHERE TO GET IT:

- City Planning and Development Office of the city/municipal hall

BUSINESS PERMIT REQUIREMENT:

- Occupancy Permit

PURPOSE: Proof that the structure where the business will operate has passed safety and health standards

WHERE TO GET IT:

- Owner or building administrator of the leased property (if renting)

- City Engineering Office of the city/municipal hall (if owned)

BUSINESS PERMIT REQUIREMENT:

- Public Liability Insurance

PURPOSE: Protection against legal liabilities as a result of bodily injury/property damage to third parties in connection to the insured’s business operation

WHERE TO GET IT:

- Any Insurance Commission-accredited insurance company

BUSINESS PERMIT REQUIREMENT:

- Authorization letter/Special Power of Attorney and valid ID (if filed through a representative)

PURPOSE: Proof that the person is authorized to transact on behalf of the business owner

WHERE TO GET IT:

- Business owner

3.Visit an LGU branch to Apply

Unfortunately, majority of the LGUs accommodate business permit applications personally. So, you really need to make a physical appearance for an application. The set-up is not a bad thing though since you can easily get the answers for all your queries and eventually asks for assistance immediately.

Can I opt for a Business Permit Application Online instead?

As we aforementioned, not all LGUs have online application system which means you must first check if it is available with your LGU branch. But if you are, for instance, around Manila, Valenzuela, Pasig, Muntinlupa City and others, you may use their city’s online business permit application service. Or you can just walk-in and submit all the requirements personally or through authorized representative of your city or municipality.

General Guidelines for Business Permit Application

1. Visit the Business Permit and Licensing Office, which is located within the city/municipal hall that has jurisdiction over your business address.

2. Secure the application form and complete it. The form can be filled out on the spot or downloaded in advance from the LGU’s website.

3. Submit the completed application form along with any additional documents which will be assessed by the personnel. Your application will also be subjected to a tax and charge evaluation.

4. To the cashier, pay the imposed tax and fees (once approved). Get a copy of your official receipt.

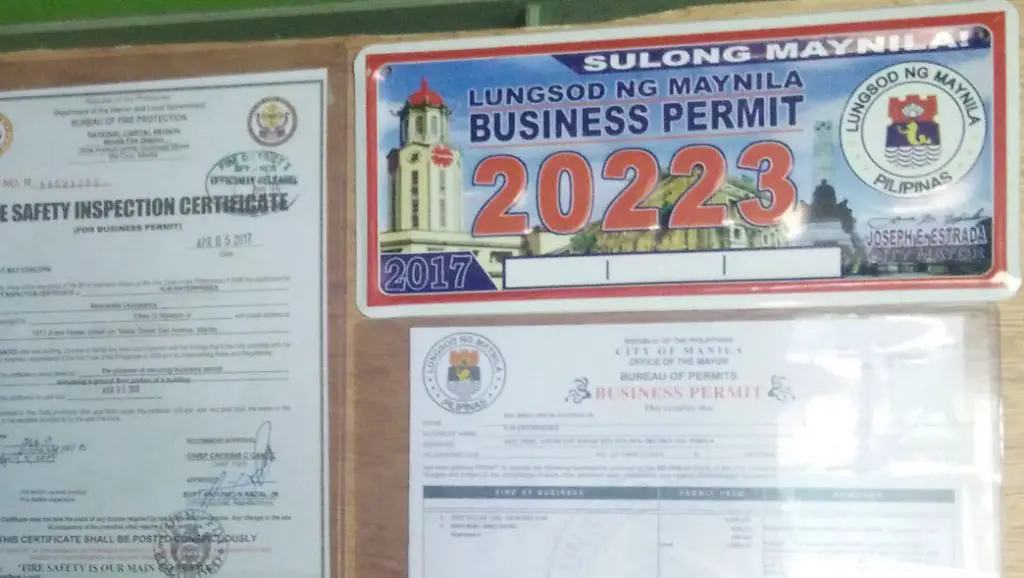

5. Get your business permit together with a registration plate/sticker or any other certificate. Make sure to prominently display them in your store or office.

Lists of Affiliated Government Agencies in Business Permit Application

Varying on the type of business you own, you may be required to register with a number of government authorities.

1. Department of Trade and Industry (DTI)

- Purpose: Applying for a business name

To begin the business permit application process, all firms, including sole proprietorships, partnerships, corporations, and cooperatives, should apply for a business name with the DTI.

Single proprietors need to submit the following:

- Duly accomplished Business Name Registration Application Form[6]

- Recent 2×2 picture

- Documentary stamps

Partnerships, Corporations, and Cooperatives should submit:

- Certified photocopy of SEC and Articles of Incorporation, Partnership

2. Securities and Exchange Commission (SEC)

- Purpose: When corporations, partnerships, and cooperatives need to apply for SEC registration

Required documents for submission:

- Name Verification Slip – This can be secured through the SEC Company Registration System (CRS)[7]

- Copy of Articles of Incorporation and By-laws or Articles of Partnership

- Treasurer’s Affidavit/Authority to Verify Bank Account

- Registration Data Sheet

- Written undertaking to change the corporate name by any Incorporator or Director, Trustee, Partner

- Bank Certificates of Deposit (notarized in a place where the bank is located)

- Other Additional Requirements

3. Barangay Unit

- Purpose: Applying for Barangay Business Permit and Clearance

After registering a business name, first-time entrepreneurs should apply for a business permit and clearance at the Barangay Unit where the business is located. You’ll have to produce a Community Tax Certificate and pay a Barangay Clearance cost of roughly 200 pesos.

4. City or Municipal Office (Business Permit and Licensing Office)

- Purpose: Securing all requirements for a Business Mayor’s Permit

If you own a building or a physical store, this is required. If your shop is located inside a mall, though, you may not require one. The inspection and issuance of the certificate will be handled by the mall management.

Business Permit Application Certificates Requirements

1. Fire Safety Inspection Certificate

- Building permit and building plan

- Barangay Business clearance

- Fire insurance coverage

- Proof of compliance to requirements and recommendations from fire safety inspectors

2. Sanitary Permit

- Most recent chest x-ray results of the business owner

- 1×1 photo

- Inspection certificate of the establishment

- Receipt of paid Sanitary Permit Fee and Sanitation Inspection Fees

Medical Certificate and Health Card issued by the City Health Officer

3. Building Permit and Electrical Inspection Certificate

- Building plans

- Lot plan

- Clearances from the homeowners association, barangay, or any other authorized offices

- Fire safety requirements

- Contract of lease and authorization of owner (if rented)

- Title, tax declaration, a tax receipt (if owned)

- Contractor’s business permit

- Sketch of your business location

- Bill of materials, specifications, structural computation

- Copy of License of the Engineer

4. Certificate of Occupancy

- Images or photos of the site

- Fire Inspection Certificate

5. Locational Clearance

- Pictures of the site

- Fire Inspection Certificate

- Building Permit

- Authorization letter from the owner (if rented)

- Electrical Permit

- Sanitary Permit

- Certification of Non-Improvement

- PRC License /PTC of the Engineer

6. Electric Utility Connection

- Letter of request from the owner

- Electrical plan

- DTI Registration or Copy of SEC Registration with Articles of Incorporation

- Copy of Lease Contract, Transfer of Certificate Title (TCT), or Deed of Sale

- Company SSS number or Tax Identification Number (if SEC/DTI Registration is not available)

Lists of fees for your business permit application

The cost of a business permit varies based on where you live. However, there are a few fees you should consider paying when submitting your business license application.

- Business Permit Processing Fee: ₱500

- Mayor’s Permit Fee: ₱100

- Sanitary Fee: ₱150

- Building Inspection Fee: ₱200

- Electrical Inspection Fee: ₱20

- Plumbing: ₱15

- Signboard: ₱50

- Fire: ₱300

- Sticker: ₱50

Source: ManeyMax