With the current technology that we have in our generation, it’s not far to think about government agencies updating their systems to give better aid to us. Like the Department of Finance (DoF), they have a tax calculator in order for people to be able to have an estimate on how much taxes the government is deducting from them.

In using the tax calculator, taxpayers will be able to have an idea on how much tax are being deducted from their pay. More so, they will be able to know the details about it. In this article, we will be discussing how you can utilize the updated DoF tax calculator and how the updates will help in connection to the new Tax Reform for Acceleration and Inclusion (TRAIN) Law.

Read: Philippine National ID: How can you Get your Phil ID?

The Department of Finance’s (DoF’s) tax calculator

In order for you to be able to utilize the tax calculator, you can do so by visiting http://taxcalculator.dof.gov.ph. Once there, you have to click on the START button.

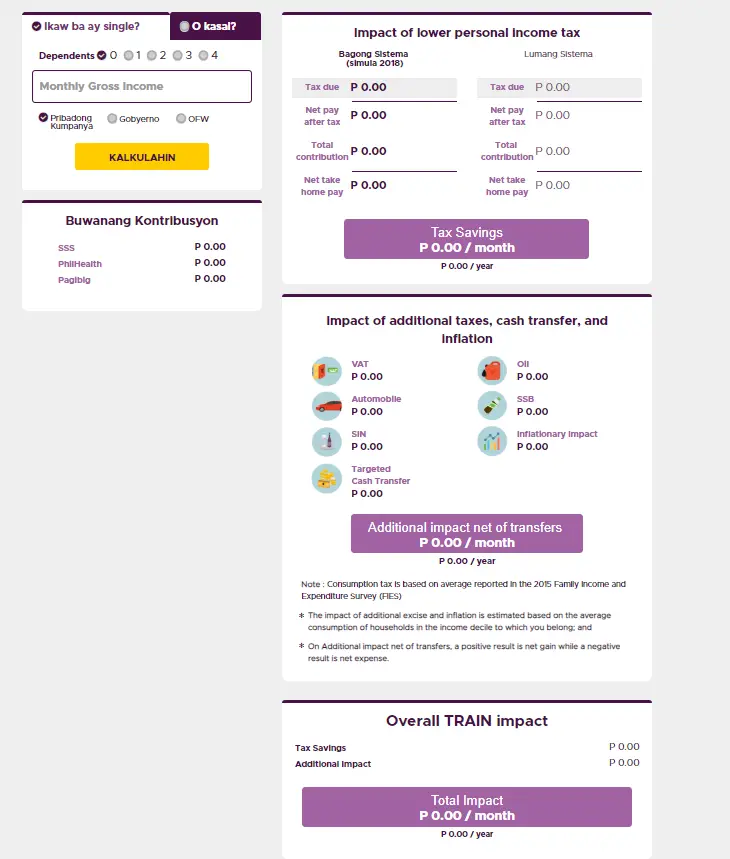

You will be asked to answer the following questions:

What is your marital status? (IF SINGLE)

- What is your gross monthly salary?

- How many are your dependents?

- Are you working for a private company? or the government?

What is your marital status? (IF MARRIED)

- What is your gross monthly salary?

- How much is your spouse’s monthly salary?

- How many are your dependents?

- Are you working for a private company? or the government?

- Is your spouse working for a private company? or the government?.

Hit on the CALCULATE button to know how much taxes you (and your spouse, if applicable) are going to have to pay based on the current Taxes Reform Acceleration and Inclusion (TRAIN) Law.

The TRAIN Law aims to modify the current taxing system, making it simple and more effective. With the TRAIN Law, every Filipino will now conspire to pay taxes in order for infrastructures and other government services to be better. This TRAIN Law was passed and is being observed during our dear President Duterte’s term with the aims of improving the services and other infrastructures that our country currently has.

Read: Higher Taxes on Alcoholic Drinks, OK-ed by House Panel

Would this new TRAIN Law affect the other benefits?

If you tried using the Updated DoF tax calculator , you would see the impact of additional taxes, inflation, and cash transfers there. Moreover, you would also see other incentives or benefits there. Good news for you because this will now not include employees who earn P250,000.00 in a calendar year. So, if you think of it, the income of employees will have an increase of 99.9 percent because of the movement of the salary ranges of people and because of the removal of these taxes.

In order to balance the economy and the taxing system of the country, 35 percent of the taxes would be implemented to the richest 0.1% of taxpayers in the country.

Income tax does not actually involve benefits, incentives, and bonuses that reach P90,000.00. More so, the minimis benefits is also exempted in this because the tax of fringe benefits of 35 percent, like the people who earn the most on the topmost ladder of the Personal Income Tax.

Having this said, would the Value Added Tax (VAT) be modified as well?

In all honesty, the Philippines is one of the few countries who has a huge chunk of VAT. On the contrary, countries in the Southeastern part of Asia are exempted from it. The TRAIN Law nulled 54 exemptions, out of the 61 in order for the system of VAT to be balanced. However, persons with disabilities (PWDs) and senior citizens are still exempted from VAT.

A new update states that medications for high cholesterol levels, hypertension, and diabetes will have no VAT starting January 2019.

To read the full article, you can click here.

So, in using the Updated DoF calculator, you have a shortcut in calculating how much taxes you will have to comply to every time you get your pay. You don’t have to make guesses now because of this technology, in fact, it will provide accurate and reliable data based on what you input!

Every taxpayer should know how much taxes they are paying. This is to ensure that the government is being fair in treating the people of the country. Before and after the TRAIN Law, the people should have an idea on the taxes they are paying because if you tihnk of it, it’s really “their” money that is being used for the betterment of the country.

What do you think about the updated DoF tax calculator? How about the TRAIN Law and its effects to the current standards that we have now?

Hi there colleagues, its fantastic post regarding cultureand entirely defined,

keep it up all the time.