The Virtual Pag-IBIG is a convenient online platform that allows members to access various Pag-IBIG Fund services anytime, anywhere. It eliminates the need for physical visits to Pag-IBIG branches, making transactions easier and more efficient. Whether you want to check your contributions, apply for a loan, or update your membership information, the Virtual Pag-IBIG portal offers a seamless experience.

In this guide, we will cover everything you need to know about Virtual Pag-IBIG, including registration, login process, available services, and frequently asked questions.

What is Virtual Pag-IBIG?

Virtual Pag-IBIG is an online service portal launched by the Pag-IBIG Fund to provide its members with digital access to their accounts. It allows members to perform various transactions, such as loan applications, savings inquiries, and online payments, without visiting a Pag-IBIG branch.

Benefits of Using Virtual Pag-IBIG

Using the Virtual Pag-IBIG portal offers numerous advantages, including:

- Convenience – Access services 24/7 without visiting a physical office.

- Time-Saving – No need to queue in branches for transactions.

- Security – The platform is secured with encryption and authentication measures.

- Real-Time Transactions – View your contributions and loan status instantly.

- Multiple Payment Options – Pay your contributions and loans online.

How to Register for Virtual Pag-IBIG

To access Virtual Pag-IBIG, members need to register on the platform. Follow these steps:

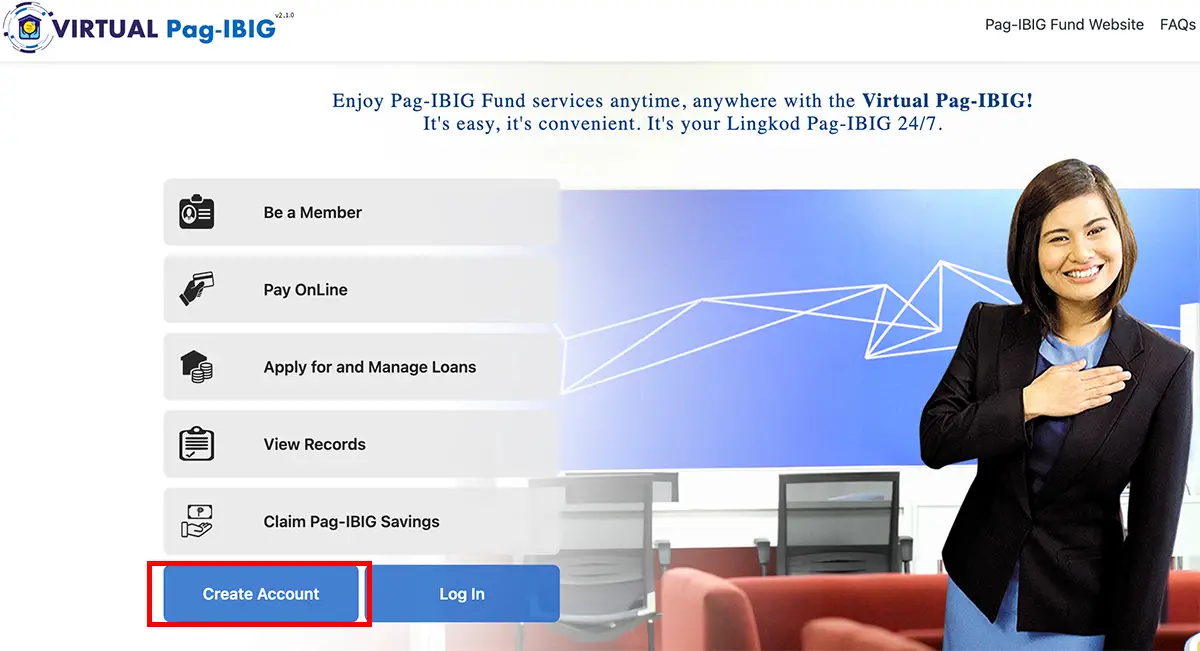

Step 1: Visit the Virtual Pag-IBIG Website

- Go to the official Virtual Pag-IBIG website: https://www.pagibigfundservices.com/virtualpagibig/

- Click Create Account

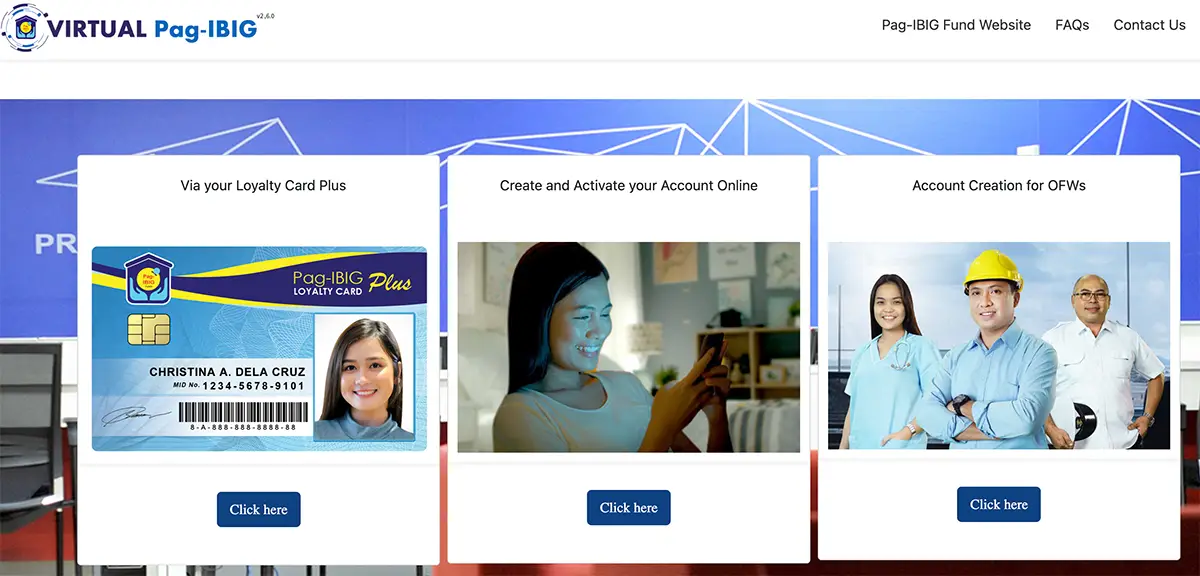

Step 2: Choose Your Registration Option

Pag-IBIG provides different registration methods:

- For Members with a Loyalty Card Plus – Register using your Pag-IBIG Loyalty Card Plus.

- For Members Without a Loyalty Card Plus – Register using your Pag-IBIG MID Number and basic personal details.

- For Overseas Filipino Workers (OFWs) – Register using passport details and OFW-related information.

Step 3: Fill Out the Registration Form

Provide the required information, such as your Pag-IBIG MID number, email address, and mobile number. Make sure all details are accurate.

Step 4: Set Up Your Login Credentials

Choose a strong password and security questions for added protection.

Step 5: Verify Your Account

A verification code will be sent to your registered email or mobile number. Enter the code to complete the registration process.

How to Login to Virtual Pag-IBIG

Once registered, you can log in by following these steps:

- Visit the Virtual Pag-IBIG portal.

- Click Login and enter your registered email and password.

- Complete the security verification if prompted.

- Access your Pag-IBIG account dashboard.

Services Available on Virtual Pag-IBIG

The Virtual Pag-IBIG portal provides various online services for members:

1. Check Your Pag-IBIG Contributions

- View your total savings and employer contributions.

- Monitor your Pag-IBIG Regular Savings (P1) and MP2 Savings.

2. Apply for a Pag-IBIG Loan

- Housing Loan Application – Submit documents and track approval status.

- Multi-Purpose Loan (MPL) – Apply for a short-term loan.

- Calamity Loan – Available during natural disasters and emergencies.

3. Pay Your Contributions and Loans Online

- Use debit/credit cards, e-wallets, and online banking.

- Generate payment reference numbers for over-the-counter payments.

4. Update Your Membership Information

- Change your contact details, employment status, or beneficiaries.

5. Get a Pag-IBIG Loyalty Card Plus

- Apply for the Loyalty Card Plus, which offers discounts and benefits from partner merchants.

Frequently Asked Questions (FAQs)

1. Is Virtual Pag-IBIG Free to Use?

Yes, accessing and using Virtual Pag-IBIG services is completely free of charge.

2. Can I Apply for a Loan Without a Pag-IBIG Loyalty Card Plus?

Yes, you can still apply for loans using other identification documents and your Pag-IBIG MID number.

3. How Long Does It Take to Process a Loan Application?

Processing time varies depending on the type of loan:

- Multi-Purpose Loan – 2 to 3 business days.

- Housing Loan – Up to 17 business days.

- Calamity Loan – 3 to 5 business days.

4. What Should I Do If I Forget My Password?

You can reset your password through the “Forgot Password” option on the login page. A reset link will be sent to your registered email.

5. How Do I Contact Pag-IBIG for Support?

For assistance, you can reach Pag-IBIG through:

- Customer Service Hotline: (02) 8724-4244

- Email: [email protected]

- Facebook Page: https://www.facebook.com/PagIBIGFundOfficialPage/

Conclusion

The Virtual Pag-IBIG platform provides a hassle-free way to manage your Pag-IBIG membership, contributions, and loan applications online. Whether you’re a locally employed worker, self-employed individual, or an OFW, utilizing Virtual Pag-IBIG can save you time and effort. By following the registration steps and exploring its features, you can maximize the benefits of this online service.

Check Also:

- LTO Portal or LTMS Portal: Step-by-Step Guide How to Register

- National Police Clearance Online Registration: 2025 Updated Guide

Good day sir/maam,

This is Ms. Rosalie Abiera, requesting your good office of my Pag-ibig number since i forgot to have my ID number. Im looking forward for your favorable response. God bless.

Hi po…pano po ba mag apply ng mp2?

Bakit ganun d ako makapag login sa virtual ko nagpalit na me ng new no. Sa pagibig ung luma pandin Arneth V. BUENAVENTE PO ITO

pwde n po ba gumawa ng bago account ng virtual d na marecover yung datinko account

Hello ma\’am/Sir, I\’ve tried to create an account on PAG IBIG.. However I\’ve recived error messgae saying \”The details you\’ve provided is not match on our record\” Please help thank you.

Good day po, update ko lang po yung loan ko kung ano na update na?

application for retirement not yet covered?

good pm po im morena kempis follow up ko lang po sana yung about sa mpl ko nagpass po ako ng requirements noong feb.4,2025