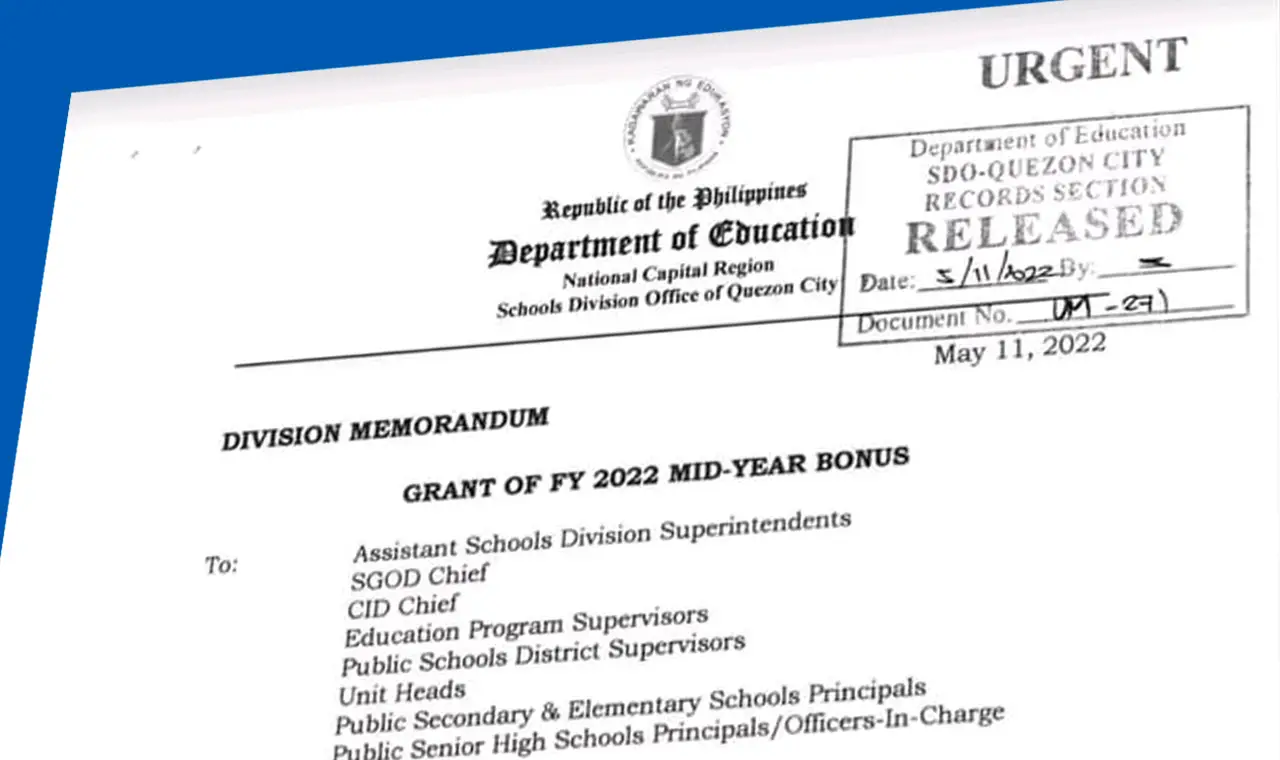

The grant of Mid-Year Bonus 2022 equivalent to one (1) month basic pay shall be given to entitled government employees not earlier than May 15. This is in accordance with DBM Budget Circular No. 20217-2 dated May 8, 2017 entitled “Rules and Regulations on the Grant of the Mid-Year Bonus for FY 2017 and Years Thereafter.”

Who are entitled to receive the Mid-Year Bonus 2022?

All government employees provided that they have meet the conditions set on the circular shall received the Mid-Year Bonus 2022.

- All positions for civilian personnel, whether regular, casual, or

contractual in nature, appointive or elective, full-time or part-time, now

existing or hereafter created in the Executive, Legislative and Judicial

Branches, the Constitutional Commissions and other Constitutional

Offices, SUCs, and GOCCs covered by the Compensation and Position Classification System (CPCS) under RA No. 6758, as amended by

Congress Joint Resolution No. 1, series of 1994, and No. 4, series of

2009, and in LGUs; and, - Military personnel of the Armed Forces of the Philippines under the

Department of National Defense and uniformed personnel of the

Philippine National Police, Philippine Public Safety College, Bureau of

Fire Protection, and Bureau of Jail Management and Penology of the

Department of the Interior and Local Government; Philippine Coast

Guard of the Department of Transportation; and National Mapping and

Resource Information Authority of the Department of Environment and

Natural Resources.

Read: Lists of DepEd Teachers’ Benefits and Allowances for FY 2022

Who are excluded from the coverage of the circular?

Unfortunately, Job Orders (JO) and Contract of Service (COS) workers are not entitled to receive the Mid-Year Bonus 2022. Furthermore, the following individuals and groups are also excluded from the circular.

- Government personnel from agencies, including GOCCs, that are

exempted from RA No. 6758, as amended, as expressly provided in their

respective enabling law or charter, and are actually implementing their

respective CPCS approved by the President of the Philippines; - Government personnel from GOCCs covered by the CPCS established

by the Governance Commission for GOCCs and approved by the

President of the Philippines pursuant to RA No. 10149; and - Those hired without employee-employer relationships and funded from

non-Personnel Services appropriations/budgets, as follows:

- Consultants and experts hired for a limited period to perform

specific activities or services with expected outputs; - Laborers hired through job contracts (pakyaw) and those paid on

piecework basis; - Student workers and apprentices; and

- Individuals and groups of people whose services are engaged

through job orders, contracts of service, or others similarly

situated.

Read: 13th Month Pay of Public School Teachers, to be Released in May

What are the rules and regulations on the grant of Mid-Year Bonus 2022?

The Mid-Year Bonus equivalent to one (1) month basic pay as of

May 15 shall be given to entitled personnel not earlier than May 15 of

the current year, subject to the following conditions:

- Personnel has rendered at least a total or an aggregate of four

(4) months of service from July 1 of the immediately preceding

year to May 15 of the current year; - Personnel remains to be in the government service as of May 15

of the current year; and - Personnel has obtained at least a satisfactory performance rating

in the immediately preceding rating period, or the applicable

performance appraisal period. If there is a need for a shorter

period, it shall be at least ninety (90) calendar days or three (3)

months, provided that the total or aggregate service under Item 1 hereof is complied with. - Those who have rendered a total or an aggregate of less than four (4) months of service from July 1 of the preceding year to May 15 of the current year, and those who are no longer in the service as of the latter date, shall not be entitled to the Mid-Year Bonus.

- The Mid-Year Bonus of personnel hired on part-time service in one or more agencies shall be in direct proportion to the number of hours/days of part-time services rendered.

- The Mid-Year Bonus of those on detail to another government agency shall be paid by the parent agency, while those on secondment shall be paid by the recipient agency.

- The Mid-Year Bonus of personnel who transferred from one agency to another shall be paid by the new agency.

- A compulsory retiree, whose services have been extended, may be granted Mid-Year Bonus, subject to the pertinent provisions of this Circular.

- Those who are formally charged administrative and/or criminal cases which are still pending for resolution, shall be entitled to Mid-Year Bonus until found guilty by final and executory judgment: Provided, that:

- Those found guilty shall not be entitled to Mid-Year Bonus in the year of finality of the decision. The personnel shall refund the Mid-Year Bonus received for that year.

- If the penalty imposed is only a reprimand, the personnel concerned shall be entitled to the Mid-Year Bonus.

Read: Government Employees’ Mid-Year Bonus to be Given Not Earlier Than May 15

Mid-Year Bonus for Personnel of Covered GOCCs:

The grant of the Mid-Year Bonus to personnel of covered GOCCs shall be

determined by their respective governing boards, subject to the following

considerations:

- The provisions on the entitlement/non-entitlement of personnel to the

Mid-Year Bonus under the Guidelines on the Grant of the Mid-Year Bonus hereof shall be strictly observed. - If funds are insufficient, the Mid-Year Bonus may be granted at lower

rates but at a uniform percentage of the monthly basic pay as of May 15

of the current year.

Mid-Year Bonus for Personnel of LGUs:

The grant of the Mid-Year Bonus to personnel of provinces, cities, municipalities and barangays shall be determined by their respective sanggunian, subject to the following considerations:

- The provisions on the entitlement/non-entitlement of personnel to the

Mid-Year Bonus under the Guidelines on the Grant of the Mid-Year Bonus hereof shall be strictly observed. - The Personnel Services limitation in LGU budgets under Sections

325(a) and 331(b) of RA No. 7160 or the Local Government Code of

1991, shall be complied with. - If funds are insufficient, the Mid-Year Bonus may be granted at lower

rates but at a uniform percentage of the monthly basic pay as of May 15

of the current year.

Definition of Terms:

For purposes of this Circular, the succeeding terms used herein shall have the

following meanings:

- Monthly basic pay shall refer to the monthly salary for regular and

contractual civilian personnel; the total daily wages for the twenty-two

(22) working days a month for casual personnel (equal to the monthly

salary of a regular personnel); the monthly base pay for the military and uniformed personnel; and the monthly honoraria for non-salaried

barangay officials and employees. - The total or aggregate service required from government personnel

for purposes of the grant of the Mid-Year Bonus shall include all actual

services rendered, whether continuous or intermittent, while occupying

a regular, contractual, or casual position in the national and/or local

government, including leaves of absence with pay.

Read: 13th Month of Pensioners, OK-ed by the SSS

For more information, refer to Budget Circular No.2017-2 by clicking through this link BUDGET CIRCULAR NO. 2017-2 (dbm.gov.ph).

Source: BUDGET CIRCULAR NO. 2017-2 (dbm.gov.ph)