The 13th month pay is a significant financial benefit for employees in the Philippines. It is a mandatory bonus granted by law, aimed at helping workers cope with the increased expenses during the holiday season. Understanding how to compute this extra income is crucial for both employers and employees.

In this article, we will discuss the basics of computing the 13th month pay in the Philippines and how much employees should expect to receive.

Legal Basis for 13th Month Pay

The 13th month pay is mandated by Presidential Decree No. 851, which was signed into law on December 16, 1975, by then-President Ferdinand Marcos. This law requires all employers in the private sector to provide their employees (Rank-and-file) with a 13th month pay, regardless of their employment status, as long as they have worked for at least one month during the calendar year.

Computation of 13th Month Pay

To compute your 13th month pay, you’ll need to follow a simple formula:

- 13th Month Pay = Total Basic Salary for the Year / 12

The “Total Basic Salary for the Year” includes all the basic wages an employee has received during the calendar year, excluding allowances, bonuses, overtime pay, and other additional compensation. The key to an accurate calculation is to determine the basic salary for each month and then add them up to get the total annual basic salary.

Let’s break down the steps:

Start by identifying your basic salary for each month of the year. This is the fixed compensation you receive before any deductions or additional payments.

Add up the monthly basic salaries to get the “Total Basic Salary for the Year.”

Finally, divide the total annual basic salary by 12 to get your 13th month pay.

It’s essential to note that the 13th month pay should be given no later than December 24th of each year, ensuring that employees have ample time to use the additional income for their holiday expenses.

Prorated 13th-Month Pay

Be aware that this annual benefit does not immediately equal one month’s pay. You will receive prorated payment for the thirteenth month if you worked fewer than twelve months this year. This implies that the amount will only be calculated using the months in which you have actually worked for the company.

Employees employed by a company in the middle or toward the end of the year typically receive prorated pay for the thirteenth month.

The computation of prorated 13th-month pay takes into account the length of service of the employee during the calendar year. To calculate the prorated 13th-month pay, the following formula is typically used:

- Prorated 13th-Month Pay = (Total Basic Salary Earned for the Year) / 12

In this equation, the total basic salary earned for the year refers to the employee’s total income from their basic salary within the period they worked during the year. The result is then divided by 12 to determine the prorated 13th-month pay.

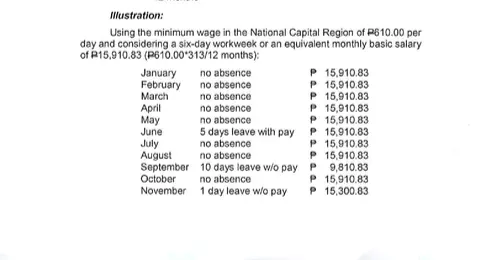

Based on the table above, the employee’s total basic salary for the year is ₱168,309.13.

Using DOLE’s computation formula, here’s how to calculate the 13th-month pay:

This is the proportionate or prorated 13th-month pay the employee should receive.

- ₱168,309.13/12 Months= P14,025.76

Tax Implications

The good news is that 13th month pay not exceeding Php 90,000 is exempt from income tax. Any amount exceeding this limit will be subject to income tax, following the regular tax rates. Employees should be aware of this exemption to maximize the benefits of their 13th month pay.

The 13th month pay in the Philippines is a valuable financial support system for employees during the holiday season. Understanding how to compute it is crucial to ensure that both employers and employees are following the law correctly.

By adhering to the simple formula provided, employees can determine how much they should receive and budget accordingly.

Source: DEPARTMENT OF LABOR AND EMPLOYMENT