Since the news broke out about the Social Security System (SSS) increasing to a 12 percent contribution, a lot of people responded, wondering how the contribution table will look like.

No worries, the Social Security System did not leave us hanging. In their Official Facebook Page, they informed every private sector worker on how the new and updated SSS contribution will look like. In addition to that, they also said that this new table will start to be effective in April of 2019.

Read: A Rise to 12% in the SSS Contribution Rate to be Effective in April

When will this be payable?

In a previous post about us discussing the 12 percent increase in the monthly contributions, Ma. Luisa Sebastian, the Vice President for Public Affairs of the SSS said that since this will be effective in April, the contributions in May should reflect the new and updated SSS contribution table.

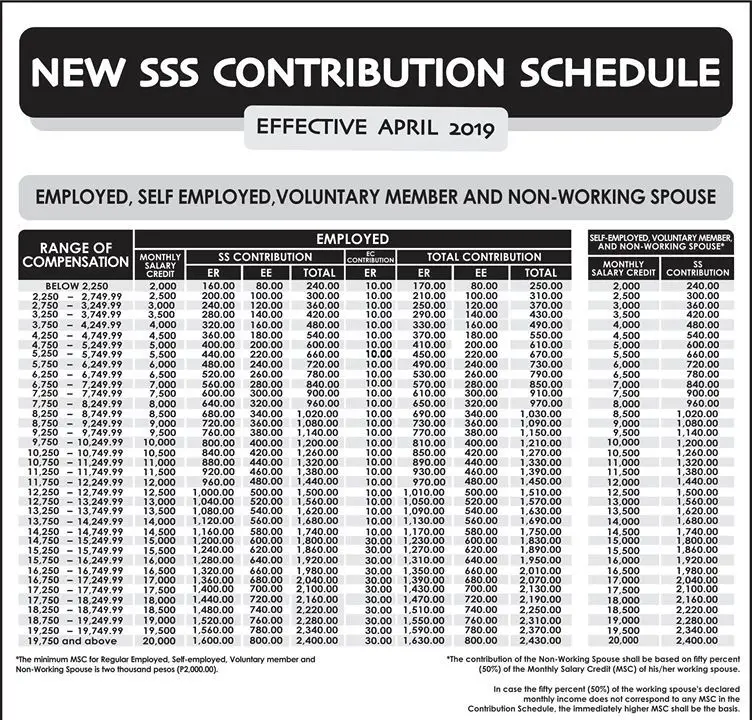

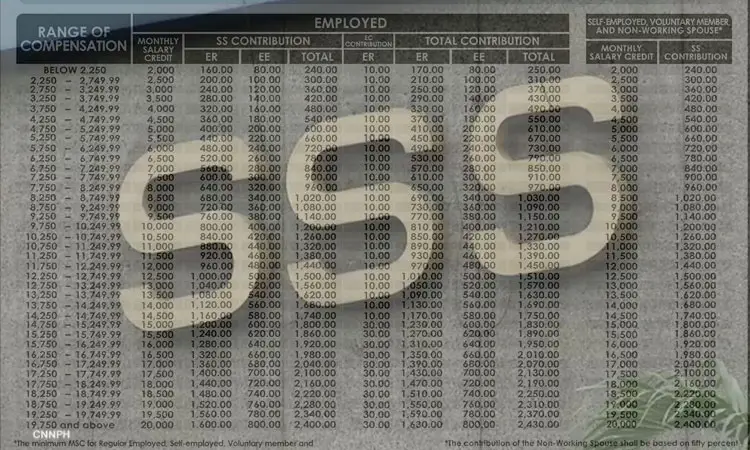

In the image above, you can see the range of compensation, how much the employed will be contributing, and how much the self-employed, voluntary members, and non-working spouses’ contributions will be.

NOTE: EC is the Employee’s Compensation. Both the employee and the employer who are registered in the SSS are not required to register again under the EC. More so, the employers are the only ones required to remit EC contributions (monthly) to SSS. This is equal to one (1) percent of the employee’s monthly salary credit (MSC). Currently, the required rate is at P10.00.

We’ll be discussing the two separately. Now, let’s start with the employed.

Read: The Jobless Insurance from the SSS, On Its Way

How the new and updated SSS contribution table will look like for the employed

As you can see, the range of compensation stems from Below P2,250.00 up to P19,750.00 and above. The minimum monthly salary credit (MSC) for employees who earn below the minimum threshold of P2,2750 has an MSC of P2,000.00. If you move further to the right, you will see that the SSS contribution of people in this salary range will be at P80.00 per month with their employer contributing P160.00.

On the other hand, employees who earn P19,750.00 and above has an MSC of P20,000.00. Employee contribution runs at P800.00 while the employers’ would be at P1,600.00.

This is fair considering the fact that the contribution will be at 12 percent in accordance to the MSC of a certain private worker.

Read: SSS Benefits Available for their Members

How the new and updated SSS contribution table will look like for voluntary members, the self-employed, and non-working spouses

As you can see, people who are not working for a private company has a similar rule. Self-employed people and voluntary members who have a monthly salary credit of P2,000.00 will have a requirement of P240.00 for contributions to the SSS.

On the other hand, members who have an MSC of P20,000.00 would have a requirement of P2,400.00 monthly.

What about the non-working spouse?

Contributions of the non-working spouse will solely be based on the percent of the Monthly Salary Credit (MSC) of his or her working spouse. It’s going to be fifty (50%) percent of the total MSC of their (working) spouse.

*Since they do not have an employer who can assist them in their contributions, they would have to settle the total SSS contributions.

Important notes to consider:

The minimum MSC for the regular employee, the self-employed, voluntary members, and non-working spouse is two thousand (P2,000.00) pesos.

What if the declared salary of the working spouse (in the case of non-working spouse) does not correspond to any MSC in the updated schedule?

In this scenario, the immediate higher MSC in the schedule will be the basis and will work as the MSC followed by the non-working spouse.

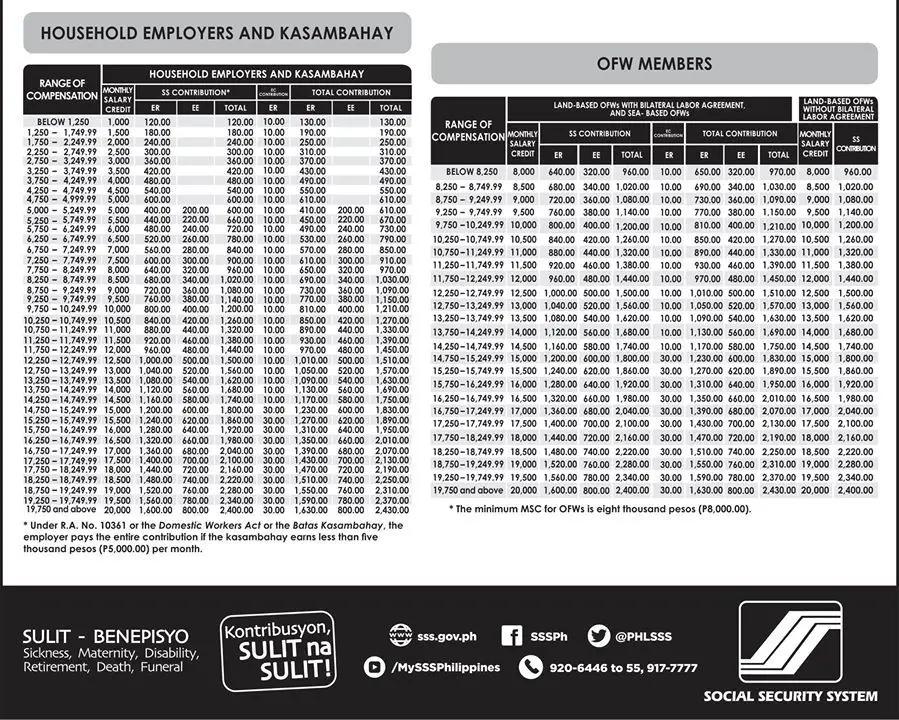

How the new and updated SSS contribution table will look like for household employers and kasambahay (domestic workers)

In this case, as you can see, the range of compensation or the minimum is P1,250.00. Unlike the regular employed, the minimum threshold for domestic workers is P1,250.00 and their MSC falls at P1,000.00. The highest, however, remains at P19,750.00 with an MSC of P20,000.00.

Read: SSS Online Registration

Domestic workers who earn below P1,250.00 will have a requirement monthly contribution of P120.00. Those, however, who earn more than P19,750.00 will have a requirement of P2,400.00, still.

NOTE: Under the Republic Act (R.A.) Number 10361 or also known as the Domestic Workers Act or the Batas Kasambahay (Kasambahay Law), the employer should pay the entire contribution of the domestic worker if the kasambahay earns less than five thousand (P5,000.00) pesos monthly.

So, if you can see on the table, people who have a salary range below P5,000.00 does not have to pay for anything in their part.

How the new and updated SSS contribution table will look like for OFW members

With a minimum MSC of P8,000.00, OFW members who earn less than P8,250.00 has a requirement of P960.00 with their employers shouldering P640.00 and them contributing P320.00.

Same thing with OFWs who earn above P19,750.00 as they will have a contribution requirement of P2,400.00.

The same thing as regards the employee compensation (EC) with the regular employees, they’re not required to pay for it.

Have you seen yourself in this table? Are you now aware of the changes as to how your SSS monthly contributions will look like after the new and updated SSS contribution table will take effect?

Just a quick refresher, these changes are rooting from the fact that the Administration approved the additional P1,000.00 monthly pension to pensioners of the Social Security System last 2017. Technically, it’s joint effort to help pensioners get more than what they’re getting with our dear President Duterte approving this modification.

Because the fund like was shortened by ten (10) years, they needed to create these adjustments in order for the agency to have a longer and a better lifespan to further serve the private workers of our country.

As per the agency, the fund life was shortened to just 2032 instead of it having a life of until 2045 to support and give benefit to private workers.

Let your family, friends, and other people know about the new and updated SSS contribution table to take effect in April 2019!

I am voluntary member of a maximum payment of 1760per month (payable quarterly) Now it will ruse up to a maximum of 2400 php/minth already .How can we pay niw we have no job by this time…Is it too high ???

Can i personally loan by yhus time?

Thank you

Good day

I have question, I already reach to 120 payments and I stop my contribution already,I’m just 36 y old as of now , What should I do stop it or continue my contribution?

Thank u

Rosalie