The Pag-IBIG Home Development Mutual Fund (HDMF) recently made a couple of announcements as regards their assistance to workers amid the threat of the infamous 2019 Coronavirus Disease (COVID-19).

One of which was their decision to provide a three-month moratorium for all loans. In addition to that, they also said that they are open to members applying for the Pag-IBIG Calamity Loan by filling out forms and submitting it to their dropboxes in any of their offices.

Read: P1.3 Billion Budget as Financial Assistance From the Department of Labor and Employment (DOLE)

Now, they’re proudly announcing that they are opening their digital world so that members are able to apply for the Pag-IBIG Calamity Loan online.

Why people want to apply for the Pag-IBIG Calamity Loan Online?

After our dearest President Rodrigo Duterte announced that our country is under a state of calamity because of the fast-paced spread of the COVID-19. This was the Presidential Proclamation No. 929 which was duly signed and signified by President Duterte.

Read: President Rodrigo Duterte Urged Business Owners and Employers to Give 13th Month Pay in Advance

It states that the entire island of Luzon will be placed under strict quarantine procedures. Moreover, it is expected that the entire Luzon island will be under a state of calamity for six (6) months unless, of course, it’s going to be lifted or extended.

Thousands of jobs and business operations have been put on hold. Because of this, a lot of companies and government agencies partook in the granting of financial assistance. For instance, several banks agreed to waive transfer fees on their online banking facilities.

Read more about that here: Three-Month Moratorium to All Loans, Pag-IBIG Fund

Our country’s state home development agency, Pag-IBIG, discussed that they are looking to allow members to apply for the Pag-IBIG Calamity Loan online. As per them, this is for the members to be given immediate financial assistance and aid, especially to areas that have been severely affected.

The Pag-IBIG Calamity Loan program seeks to provide immediate financial aid to affected members in calamity-stricken areas.”

Is Pag-IBIG only offering the Calamity Loan online?

In their official Facebook page, the Pag-IBIG made the announcement that they are opening their doors to their members by allowing the Calamity Loan and the Multi-Purpose Loan Program (MPL) application to be one online.

So basically, all Pag-IBIG members can take advantage of this situation and apply for the Pag-IBIG Calamity Loan or the Pag-IBIG MPLfor financial aid and assistance.

How can members apply online?

For members who do not have printers, Pag-IBIG adjusted and made the loan forms fillable online. Here’s what members have to do:

- Fill-out the fillable form

- Multi-Purpose Loan (MPL) Form

- Calamity Loan Form

- Once the form has been completed, members can save it as a PDF file.

- After, members can send the PDF file via email to their company’s Human Resources (HR) team; a company authorized representative; or the company’s fund coordinator.

NOTE: The reason why members have to send it to their employers is because their employers need to sign the application agreement in the form.

Requirements to apply for the Pag-IBIG Calamity Loan online

People who are eligible to apply would be people who are living in or residing in an area that has been affected by the declaration of our President to be under a state of calamity. In addition to that, here are some documentary requirements:

Read: The Department of Education (DepEd) is Working to Release Employees’ Salaries Early

- Duly accomplished Pag-IBIG Calamity Loan or MPL form;

- One (1) valid I.D. (front and back images)

- Loyalty Card Plus (front and back images)

- LandBank or DBP Cashcard

- At least twenty-four (24) monthly membership savings or contributions

- Sufficient proof of income

NOTE: Members who have an existing Pag-IBIG Fund Housing Loan, Calamity Loan, or MPL, payments should be updated in order for their applications to qualify. The amount remaining will be deducted to how much they’ll be receiving.

How can members know if they are approved?

In determining the results of their online application, members will receive a text message that will confirm their approval. Furthermore, they’ll also be informed whether it’s credited in their Loyalty Card Plus or their Landbank or DBP Cashcard.

Read: You Can Avail a Pag-IBIG Calamity Loan P20K Up Depending on Your Contribution

What if I don’t have a Loyalty Card Plus, Landbank, or DBP Cashcard?

First-time borrowers are advised that they’ll be contacted by representatives for them to know how they’ll be able to receive their loan proceeds.

How much can members borrow?

Based on Pag-IBIG Fund’s website, applicants who will be qualified can receive an amount of up to 80% of their total Pag-IBIG Regular Savings. The Pag-IBIG MS usually consists of:

- Employee’s monthly contributions

- Employer’s contributions

- Accumulated dividends earned

Applicants can apply for the Pag-IBIG Calamity Loan online within a period of 90 days from the date of the declaration of the state of calamity. Meaning, people in the National Capital Region (NCR) can apply 90 days from March 17th, 2020.

Read: Fact or Fiction: Can Bananas Save You From the 2019 Coronavirus Disease (COVID-19)?

As per Kalin, the Pag-IBIG Vice President, they would gladly accept the applications from members who are:

- in the NCR Region

- Part of the Luzon island

- Part of areas that have been declared to be under an Enhanced Community Quarantine (ECQ) whose livelihood have been disrupted

Processing time

The usual processing time of the applications after submission is less than two (2) days. However, with this pandemic, they do not have a specific timeline of when the application will be processed, says Kalin Franco-Garcia, Vice President of the Pag-IBIG Fund.

This early, we apologize to our members as our usual processing time takes less than two days. However, in this pandemic that we are currently facing, we would like to assure our members that Pag-IBIG Fund is doing everything it can to release loans as fast as possible.”

Read: The Catholic Church Will Go Online For The Holy Week

Loan repayment terms

The loan repayment terms remain as usual; it’s still payable within twenty-four (24) months. In addition to that, the initial payment for the loan they’re getting will be payable on the third (3rd) month after the loan has been released.

Where can I email my MPL or Pag-IBIG Calamity Loan Application?

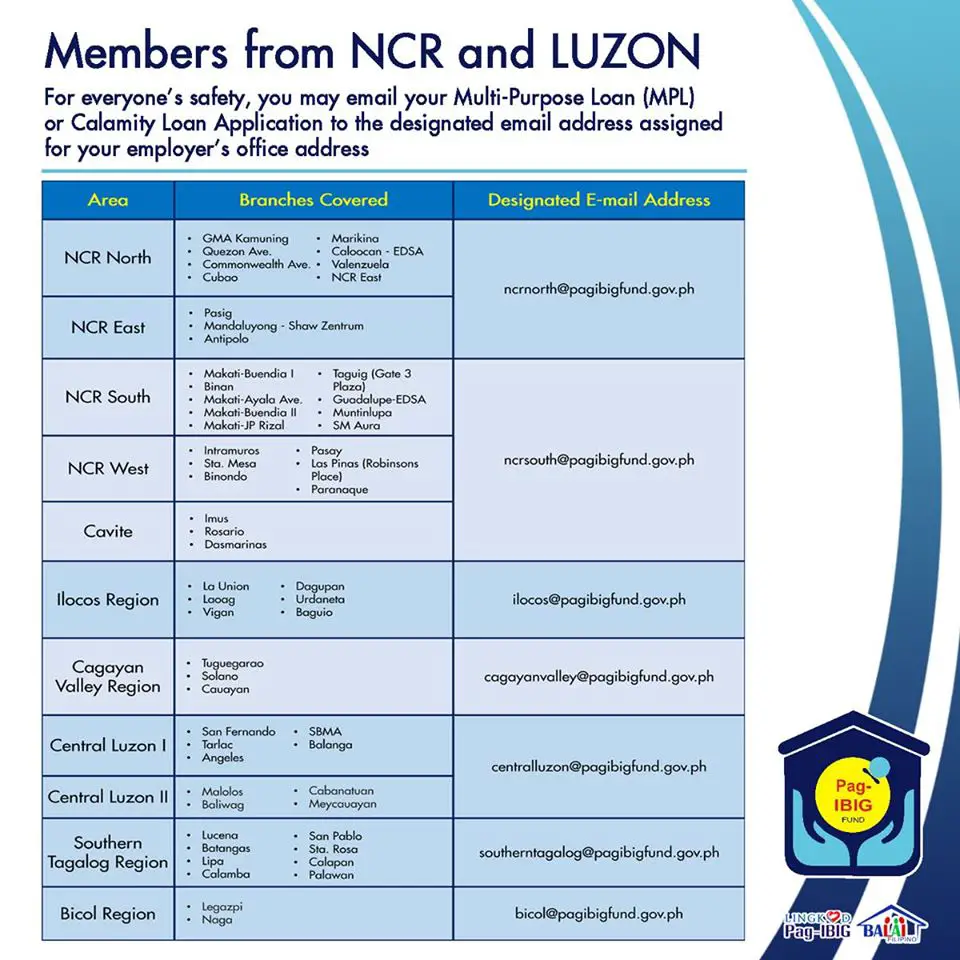

People from all over the Philippines, specifically the island of Luzon, everyone is directed to send their application forms to the following email addresses based on their location.

Members from Luzon and NCR

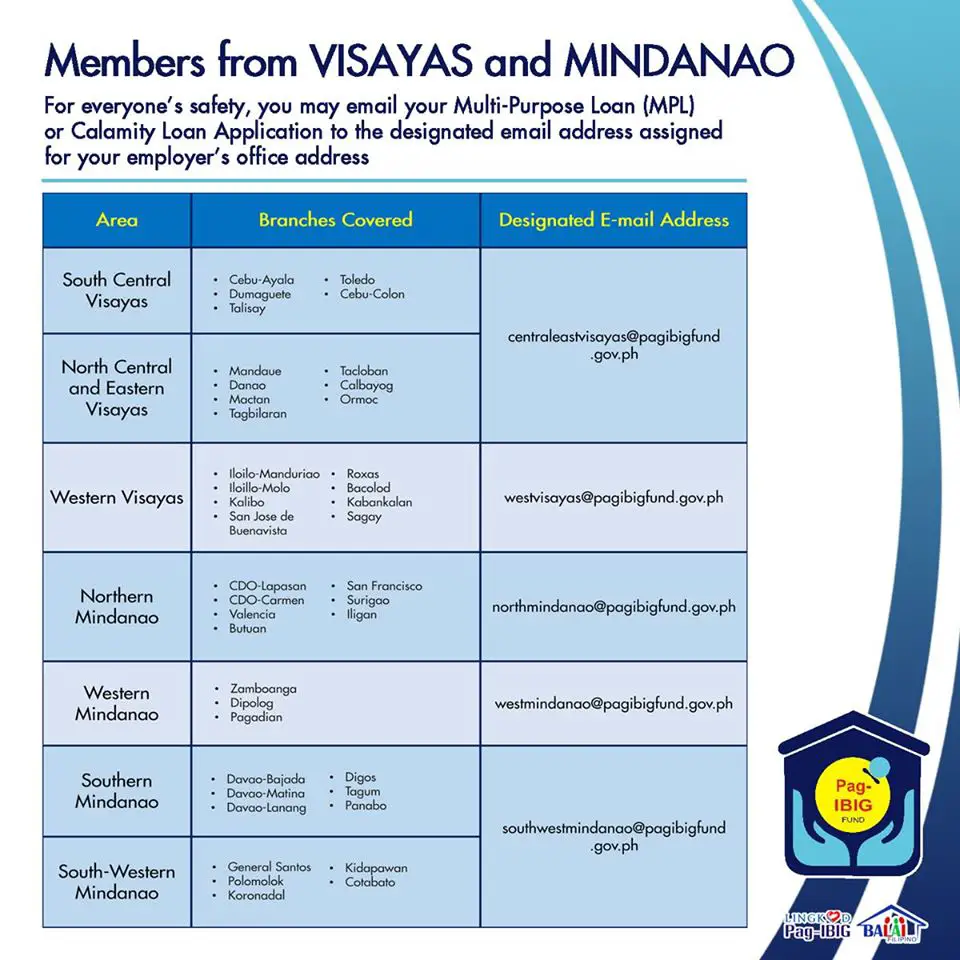

For members in the Visayas/Mindanao Region

With the Pag-IBIG opening its doors to its members, we can expect financial aid and assistance from them. What do you think about their decision to allow members to apply for the Pag-IBIG Calamity Loan online? Can this aid the public who have lost their jobs due to the outbreak of the virus?

Source: Pag-IBIG Fund Official Facebook Page

For card disbursement DBP po wla s choices paano po ako mkkpag apply for calamity loan

Magandang araw po , ahm baka dito ako nkahingi ng cash assistance kasi di naman ako nabigyan ng ayuda galing sa DSWD.. No work po ako as of now, nagresign po ako sa work ko tapos po naglockdown sa Manila while kumukuha pa lang po ako ng NBI clearance. Pero member po ako ng PagIbig, 1-2 years palang po ako. Pwede po ba ako makakuha ng cash assistance para po sa expenses habang naghahanap pa lang ng work? Magbbayad po ako kahit cash makahanap lang ng work.. Sana manotice po ako.. ASAP!

PagIbig no.: 121179718527

Unsaon pag loan sa calamitu? Ok raba mag loan sa calamity nga naa pa loan sa MPL?

mam I did not receive any text from pag ibig if my loan was approved or not

San po pde mg ff up?kc until now wla p ung s amin april 8 p ngsubmit

Ang calamity loan needpaba dadaan sa hr or pwd personal akong mag email

Thru online yun dun sa member log in SSS portal then need notify employer/hr para approved nila sa online din yun, pero sa ngayon not accessible pa member log in dahil sa sbws.

Pwee po ba mag avail kahit self employed/ voluntary member?

All qualified members pwd, basahin Ito para sa buong detalye:https://announcement.ph/sss-covid-19-calamity-loan-program-to-be-launched-on-the-24th-of-april/

Kami po ma’am nung april 9 pa po ngpasa as per hr namin wait lng daw namin yung text pero hanggang ngayun po wala pa din reply panu po kaya namin yun mapapafollow-up tnx po

bakit message block ang lumabas s pag send ko ng applicatgion form ko

Sa April 24 pa launching nun.

hnggng ngaun wala pa ung mpl loan ko nung march pa. refiling ko nga sa h r nmen nung april. hnnggng ngaun wala pa. bakit po ganun. hngng ngaun wala pa akong natatnggap na txt. ibig svhin po ba hindi naaprobahan loan ko? imposible nman.

Ask lang po kong ano gawin kng nakalimutan po ang PIN# ng ATM card ng Pag-ibig member? Thanks po

Hi Ma’am, ilang days po para malaman kung approved po yung application ko fo calamity loan. nagpasa po ako sa HR namin. nasubmit na daw po sa pag-ibig April 6, 2020. until now po wala pa ako natatanggap na confirmation. salamat po

According to Pag-IBIG matanggap ang inyong loan sa loob ng pito (7) hanggang dalawampung (20) araw.

Aaa

Pano po wlang cash card? San po ako pwd maka avail ng cash card?

Mam pwede po ba ako makapag apply calqmity loan kahit taga carmona cavite po ako kase po nabasa ko sa imus dasma rosario lang po pwede

Nakaapply na po result lang matagal 1wik pa ng march wl p result.bk naman po malaman status kc lockdown kailangan po kc d kasama sa mga ayuda ng gobyerno.pls.naman po pakihelp n.thank you and God bless

Mam what f kung wlang loyalty card 37 months n po nhulugan yung pg ibig ko loyaltycard lng kulang q n req.mkakaavail b ako thrue online?

Pag-IBIG loan po ba concern mo? coordinate ka po sa HR dept. ng company nyo.

how can I apply for this loan if I have an MPL loan which they dont deduct it yet?

According to Pag-IBIG the amount of loan you will receive shall be the difference between the 80% of your total Pag-IBIG regular savings and the outstanding balance of your loan/s.

Please advice or I need to know the link of calamity loan form to fill up.

How can i do if i have some existing loan which is salary loan in pag ibig.. Can i avail a calamity loan

Even if i have my exist loan on pagibig??

If you have an outstanding MPL/Calamity Loan, the amount of loan you will receive shall be the difference between the 80% of your total Pag-IBIG regular savings and the outstanding balance of your loan/s.

pwd

Pede po bng sabay iloan ang MPL at CALAMITY LOAN po s PAG ibig, salamat po

yes po.

pwd

paano po pag walang loyalty card?? calamity loan po sana kaso wala pa po akong loyalty card .

Sa Pag-IBIG ata yung loyalty card po.

Pwude po mag calamity loan khit my MPL

Pwd, pero Not available as the moment Ang Calamity loan,tinanggal muna nila member log in sa SSS Portal para nagbigay daan sa mga employer na nag process ng kanilang sbws. Thanks

Mam paano mg pamember po s pagibig kc po ofw gsto k sna mghulog